Can I Put A Money Order Into My Bank Account

Whether information technology's to pay back a friend or family member, split utilities with a roommate, or maybe even make a payment overseas, sometimes yous need to transfer money into someone else's bank account.

If y'all're not sure where to kickoff, or what transfer method volition be right for you, read on to find out what you lot demand to know.

You lot'll learn all about sending money within the US and also how to save when sending money overseas with Wise, which is 6x cheaper compared to other alternatives.

| 📝 Here are the 6 ways to transfer money to someone else |

|---|

|

ane. Greenbacks

One of the most common ways to transfer money to someone else is to do information technology in cash. You lot tin withdraw cash from your own banking concern account either at a bank co-operative or past using an ATM.

Then you can evangelize the cash to the owner of the recipient depository financial institution account in person, allowing them to deposit information technology themselves, or you tin can go to a branch of their depository financial institution and ask to eolith money into their bank account.

All the same, some banks and other financial institutions don't permit depositing cash into another person'southward account because of the high likelihood of fraud with cash payments. So this might not exist the best way of doing this.

2. Wire transfer

If yous've always heard someone in a movie say they'll "wire" coin to someone, this pick might sound daunting. Only it'due south actually easier than you'd think. Wire transfers are only a method banks employ to move money betwixt each other electronically.

For most banks, you'll have to go make a wire in person. If your bank is in another part of boondocks, or y'all have a jam-packed schedule, this can be an issue.

Wires are a fleck pricey, besides: depending on your bank, the price may range anywhere from $15 - $35 or more. If you're looking to make an international wire transfer, costs go upwards even more.

On peak of the upfront fee from your banking concern (which may range from $35 - $60), you'll be striking with poor commutation rates and flat bank fees from possibly upward to 3 contributor banks.

International transfers also take a chip more time. Anywhere from 1-v business days, depending on your recipient'south land.

| 💡 Cost and fifty-fifty speed-wise, you're almost always better off using Wise over your bank for an international wire (SWIFT) transfer. |

|---|

3. Sending money online

Mayhap you've heard of these apps and services that let you transfer money online on a website or via an app.

In this scenario, your recipient will already need to be registered with the service. From inside the service, you tin can send them money.

Once your recipient knows you lot've sent them coin, and it's waiting in a residuum for them.

This works with services like:

-

Facebook Pay

-

Zelle

-

PayPal

-

Cash App

-

Venmo

Simply, let's confront information technology, your granny'south probably never going to sign upward for it.

Which means if you're sending coin to someone who isn't so tech-savvy, you may need some other options that don't crave them to buy a smartphone and download some apps.

4. Wise

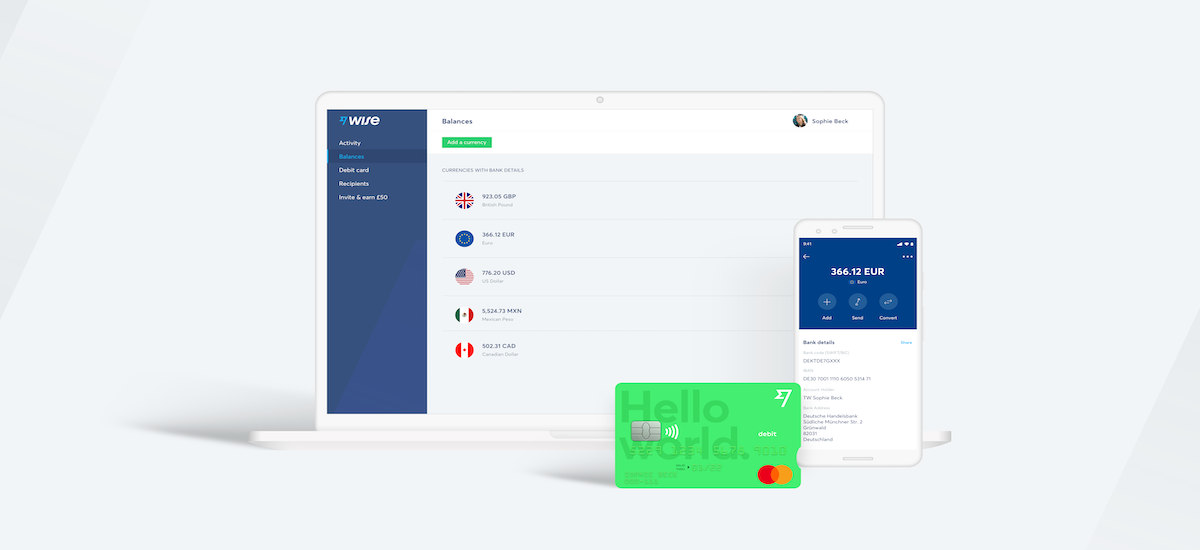

To send money directly from your bank business relationship to another account, inside or outside the U.s.a., Wise tin can be a great option.

Their smart, new technology connected local bank accounts in respective countries, skipping hefty international bank fees and helping normal everyday folks relieve upward to 6x compared to other alternatives.

You tin can sign up for a Wise business relationship for free. No monthly charges. You'll discover only pocket-size, fair fees when you switch between currencies or send coin within the Us or away.

In one case you're all set upwardly, you can begin holding a residuum in dozens of currencies — sending your money all over the world. Or simply within the US.

You can besides get the Wise menu, which you tin use to pay for appurtenances and services all over the world.

Get a free Wise account today

v. Check

A mutual mode to transfer coin is simply by writing a check, which tin can you can evangelize in person or transport in the mail.

Just fill up out a check, paid to the club of the other person, or "cash." Either yous or your intended recipient will and then demand to deposit the bank check into their bank account.

While checks are getting less and less common these days, there are many banks still accepting them.

half-dozen. Coin society

If you're going to mail the money, a coin order is a more secure alternative to cash or a check, since it tin be traced and canceled if it gets lost or stolen.

The fees for money orders depend on the provider, await to pay around $2 for domestic coin orders and up to $12 for an international one.

Equally you pay in advance for a money order, it means in that location's no need to proceed sufficient funds in your account while y'all wait for it to be cashed.

| 💡 You can buy a money order at places like the Mail Office, a Western Marriage location or Walmart. |

|---|

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which information technology deals. It is not intended to amount to communication on which you lot should rely. You lot must obtain professional or specialist advice before taking, or refraining from, whatsoever action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Express or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or unsaid, that the content in the publication is accurate, complete or up to date.

Source: https://wise.com/us/blog/how-to-transfer-to-another-bank-account

Posted by: rouseingesed.blogspot.com

0 Response to "Can I Put A Money Order Into My Bank Account"

Post a Comment