How To Get Money Out Of Cayman Corp To Us

Cayman Offshore Company and Bank Business relationship

Are you interested in registering a company and opening a banking concern account in a jurisdiction with flexible corporate structures, tax neutrality, sensible reporting requirements, and a strong legal history? A Cayman Islands company and bank account may be what yous are looking for. As long your provide the appropriate know-your-client documentation we can frequently register your visitor inside 24-48 hours of blessing. Keep in mind, this time is not a guarantee as we depend on the Cayman authorities.

If you want to open up a bank business relationship for asset protection, the Cayman Islands is another fantabulous choice. Its bank secrecy laws are among the toughest in the globe. That is, any party who discloses unauthorized information is bailiwick to strict criminal penalties. Under the 2009 revision in the Confidential Relationships (Preservation) Police force, it is illegal to divulge confidential information. It is likewise illegal to attempt, offer or threaten to divulge confidential information, or willfully obtain or try to obtain such confidential information.

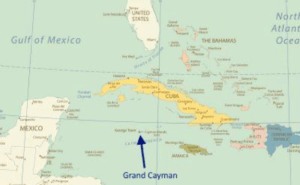

About the Cayman Islands

Located in the western Caribbean Sea, the Cayman Islands consist of Chiliad Cayman, Little Cayman and Cayman Brac. The overall population is approximately 62,000. The capital, George Town, is located on Grand Cayman Island. The Cayman Islands gained independence from U.k. in 1960. Though, they remain a British territory and thus part of the Britain. Yes, major financial hubs such as New York, London, Hong Kong and Tokyo are better-known. George Boondocks is, surprisingly enough, the 5th-largest financial centre in the world, afterwards these huge metropolises. The financial services industry is a major employer in the Cayman Islands. That is, the region features hundreds of banks, including many foreign bank branches. As such, there is no shortage of professionals providing services to the financial industry, including lawyers, accountants and coin managers.

The Cayman Islands savour an international reputation as a trusted financial center, and office of that is due to its strict banking secrecy. Some other advantage –English is the official language of the Cayman Islands. And then, there is no need for document translation for U.Southward. based or other English-speaking countries. In addition, the Cayman Islands observes Eastern Standard Time. Then, for much of the twelvemonth it is in the aforementioned time zone equally New York City and other areas of the U.S. Eastern Seaboard. However, the Caymans practise not observe Daylight Savings Fourth dimension. So, note the one-hour earlier difference during this time of year. The similarity in time zones makes communicating directly with professional fiscal service or government representatives for those in most of the U.Southward. much easier.

Cayman Islands Bank Account

Opening a bank account in the Cayman Island does not differ much from opening an account at your local bank. They demand your identification and an application. Since you are not necessarily meeting them contiguous, they volition need know-your-client documents shown beneath.

What are the advantages of opening a bank account in the Cayman Islands? Commencement, such accounts, combine with an asset protection trust, offer asset protection from lawsuits. In the U.S., a court tin rule that funds held in a U.S. bank go directly to creditors or others receiving a judgment. If funds are held in a Cayman Islands depository financial institution in an international trust, a U.Southward. court does not take the jurisdiction over strange banks and trustees.

Proceed in mind that foreign financial institutions are required to report tax information to the IRS. In the Cayman Islands, such institutions must written report tax information regarding U.S. business relationship holders to the Cayman Islands Tax Information Dominance (CITIA). This agency is the only histrion in the Caymans when it comes to providing tax information to the government of other countries. Then, it is CITIA that reports such data to the IRS.

Open an account via mail or the net. The bank will require y'all to provide evidence that there is no fraud or money laundering participation. Such evidence may include:

- Copy of your passport

- Other identity proof

- Financial information from a current banking company

- Recent pay slips

- Residency proof

In addition, they volition often need a bank and/or professional reference alphabetic character. These documents show that you the i opening the account. Plus, it helps them comply with international money laundering regulations.

Cayman Bank Interest Rates

You may find interest rates on bank accounts in the Cayman Islands like to those where you lot reside. If they were significantly college, in that location would be a rush of flight capital and other banks would need to heighten their interest rates to compete. So, I would non wait interest rates to exist much college or much lower than they are back dwelling house. In that location are, still a tremendous number of investment options.

For example, if you want to diversify your portfolio, many Cayman banks offering investment management services. We see clients earning viii% to 12% annually in these managed portfolios. Keep in mind, this is not straight bank interest. This is in having an business relationship manager that diversifies your funds over a broad array of investments.

Cayman Islands Exempted Companies

The nearly common type of Cayman Islands offshore company is that of the exempted company. There is no minimum capital requirement for establishing such a company, and annual fiscal statement filing is not necessary.

If a visitor's primary objectives take place in a location other than that of the Cayman Islands, information technology may apply for an exemption registration from the Registrar of Companies.

Exempted companies cannot trade in the Cayman Islands with the entity; that is, with the exception of business furtherance of the exempted company exterior the Cayman Islands. An exempted company cannot make a public invitation in the Cayman Islands for share or debenture subscription. However, the regulations allow Cayman Islands residents to concur exempted company shares. In addition, one may use shares of exempted companies to hold some other exempted visitor. In addition they can hold Cayman Islands exempted express partnerships, limited liability companies and can have roles in foundations.

Exempted companies must submit memorandums of association and articles of association. The one-time document contains the company name, which must differ substantially from any existing company and so there is no confusion equally to the identity. The Registrar may not accept company names including certain words, or must formally consent to such names, among them:

- Banking company

- Insurance

- Regal

- Trust

Exempted companies do non need to include words such as Ltd. or Inc. in the company name. Registration using the terms LLC or Limited Liability Company is not allowed for corporations. Naturally, they are immune for LLCs. Each exempted visitor must have a Cayman Island registered office. The provider of this role must have a license for this activity.

Memorandum of Association

The memorandum of association must besides include the objects and powers of the company. Such objects are limited only to those provided in the document. The company does accept the option of choosing unrestricted objects. Thus, this permits it to deport out any lawful purpose. This document must include a Announcement of Limited Liability, stating shareholders liability as limited to unpaid amounts on occasion on these shareholders' shares. The exempted company principles may instead decide that shareholder liability is limited to the corporeality such shareholders agree to contribute to the company if information technology ceases operation. However, few people select this option, and opt for maximum liability protection.

The final section of the memorandum of association concerns authorized share capital. The exempted company must country the corporeality of authorized share capital. It must too include share numbers and their par value, in one or multiple currencies. A company might include a capital dividend if the division into shares has no par value. Information technology cannot, however, divide uppercase into unlike shares, with some having a par value and others not. Every bit in most jurisdiction present, bearer share issuance is non permitted.

Articles of Association

The 2nd certificate, the manufactures of association, provide for full general company assistants. It should include guidelines on the following:

- the outcome of fellow member meetings and voting rights

- share issuance, transfer and redemption

- dividend payment

- how the company might liquidate.

The articles of association besides deal with directors' and officers' appointments and their powers. Usually, at least i managing director is necessary for a Cayman Islands company, only such individuals practice not have to reside in the Cayman Islands. In most cases, the articles of association state that a company's direction is the board of directors' responsibility.

Register Maintenance

All exempted companies must maintain three registers. The kickoff is the Register of Directors and Officers. This includes not only the names and addresses of these people, but their appointment and leaving dates. This register requires filing with the Registrar.

The 2d annals is that of members. As such, it must include shareholder names and addresses. In addition, it includes the number of shares each agree and whether voting rights are involved. It also states the amount paid for the shares. This annals must likewise include the engagement each shareholder obtained shares, and the date on which they were no longer company shareholders. As long every bit the company is not licensed to do business in the Cayman Islands, this register does not need to stay in the country.

The third register is that of mortgages and charges. Thus, it must include data regarding whatever mortgage or charge affecting visitor property. The register must state the names of mortgagees, every bit well as a description of the mortgaged property.

Exempted Cayman Companies and Bank Accounts

Exempted companies can open depository financial institution accounts in the Cayman Islands by providing all incorporation paperwork. This includes including certified copies of the Memorandum of Association and Articles of Association. The banking company will also need a certified register of members. For the purposes of opening a banking company business relationship, the Cayman bank also requires a certified minutes of the initial directors' meeting. Identities of all beneficial owners and directors are needed, along with certified copies of their passports and residency proof.

Cayman Islands Taxes

The Cayman Islands do not levy a corporate income tax. Additionally, they also do not levy on income or majuscule gains for exempted companies that have applied to the Governor for an undertaking. Such an undertaking is good for a total of 50 years, and includes inheritance or estate revenue enhancement, if warranted.

Moreover, non-residents are not subject area to withholding taxes on dividends or interest, or royalty payments. The Cayman Islands does non impose a personal income taxation or tax on capital gains. There is too no value-added or corporation tax.

The only taxes the Cayman Islands practise levy are stamp duties on various backdrop, and steep import duty tariffs.

How to Open a Cayman Company and Banking company Account

Do you desire to open a Cayman company and bank business relationship? If and then, please complete the free consultation form on this page. Alternatively, you tin call one of the telephone numbers listed here. There are experienced offshore visitor consultants here to help you lot. If you do non get ahold of someone immediately, please keep trying until you get ahold of one of our experts.

Source: https://www.offshorecompany.com/company/cayman-company-bank-account/

Posted by: rouseingesed.blogspot.com

0 Response to "How To Get Money Out Of Cayman Corp To Us"

Post a Comment